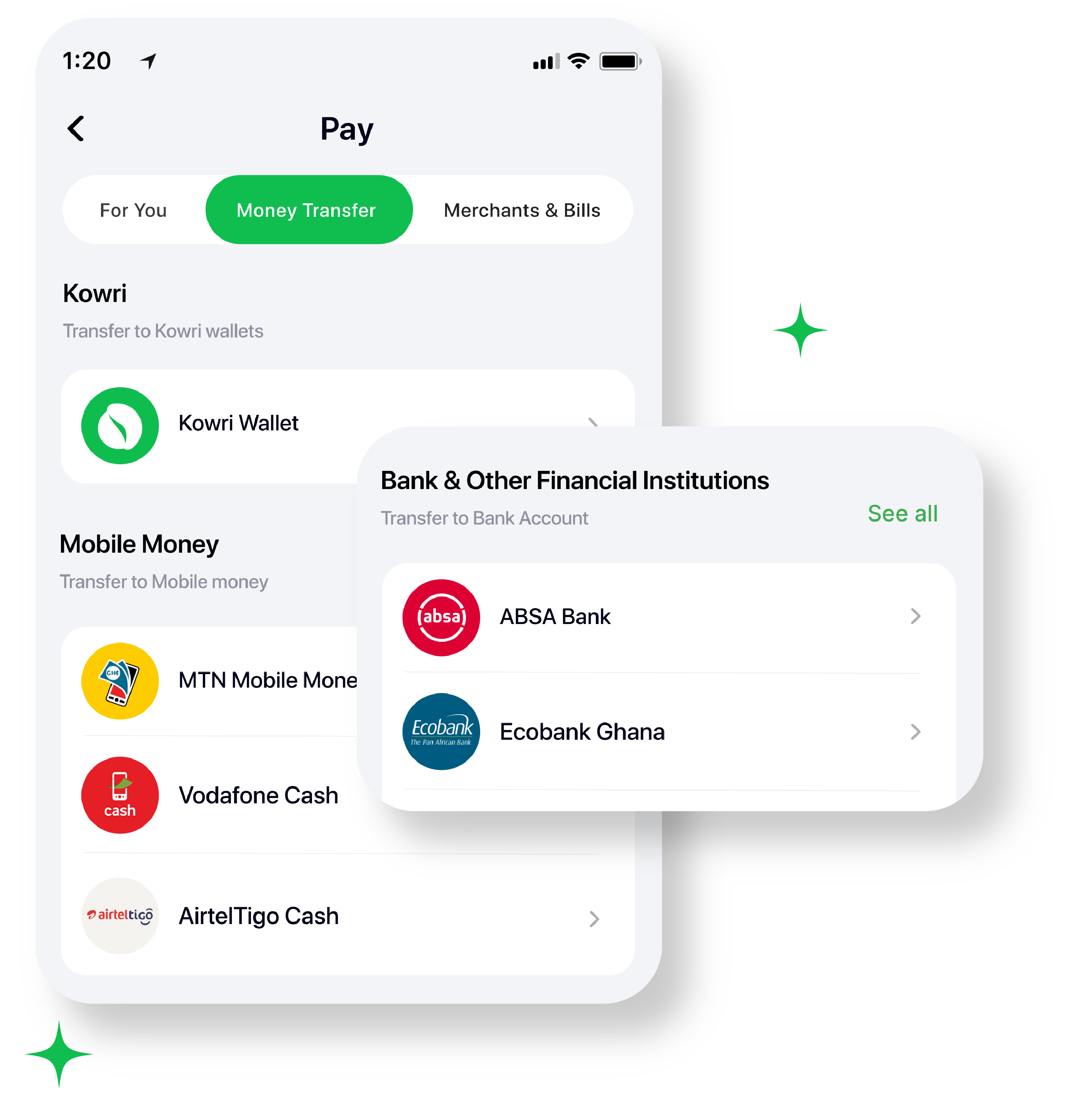

Send money! It’s fast.

Move your money in quick, easy steps at the smartest rates on the market.

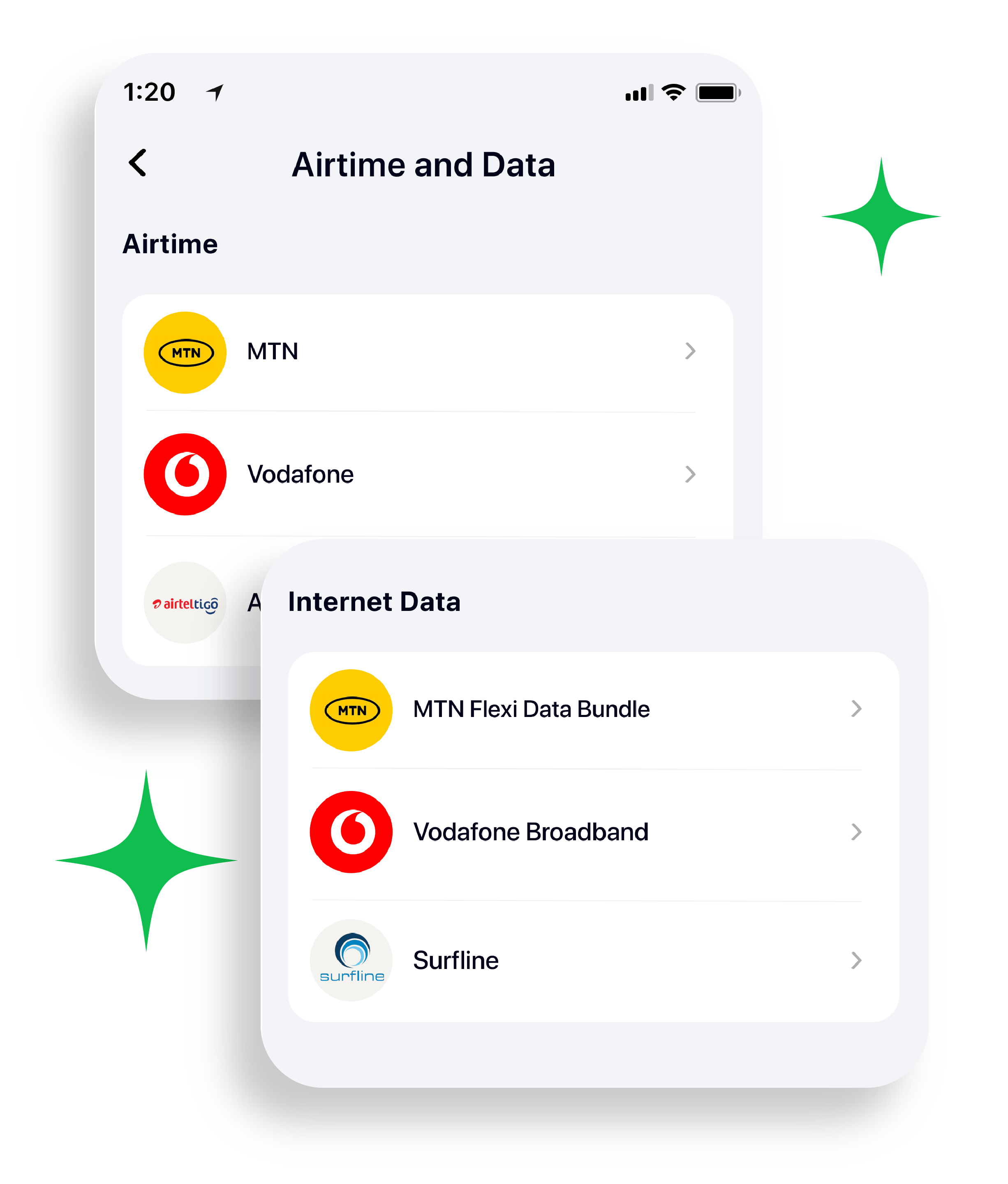

Buy Airtime and Data. Enjoy Discounts!

Buy airtime and data for yourself and loved ones in less than 3 easy steps. Enjoy discounts on airtime and data purchases.

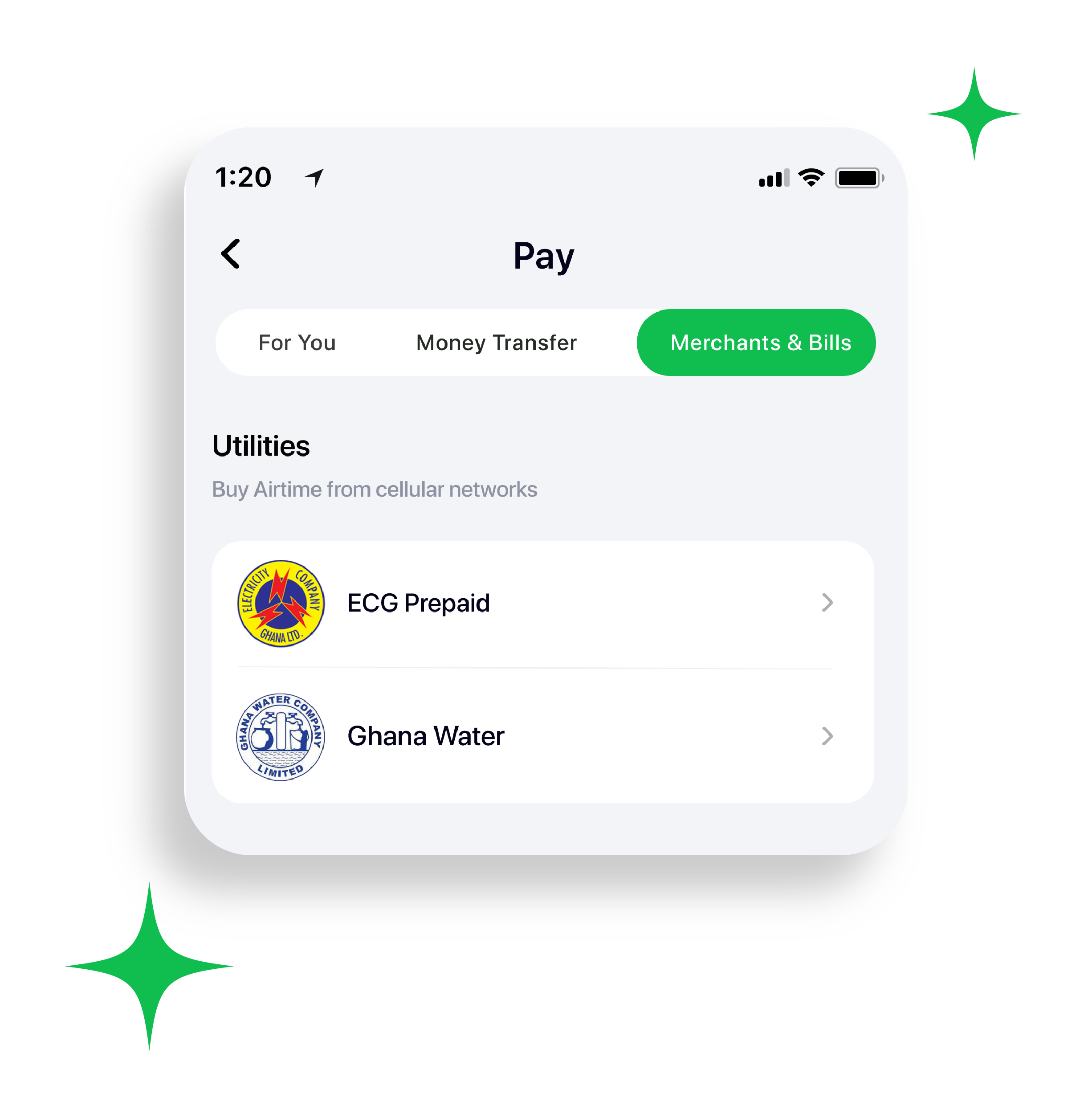

Pay bills. It’s Instant!

Got pending data, water and electricity bills? No problem. Pay for all these and more with Kowri.

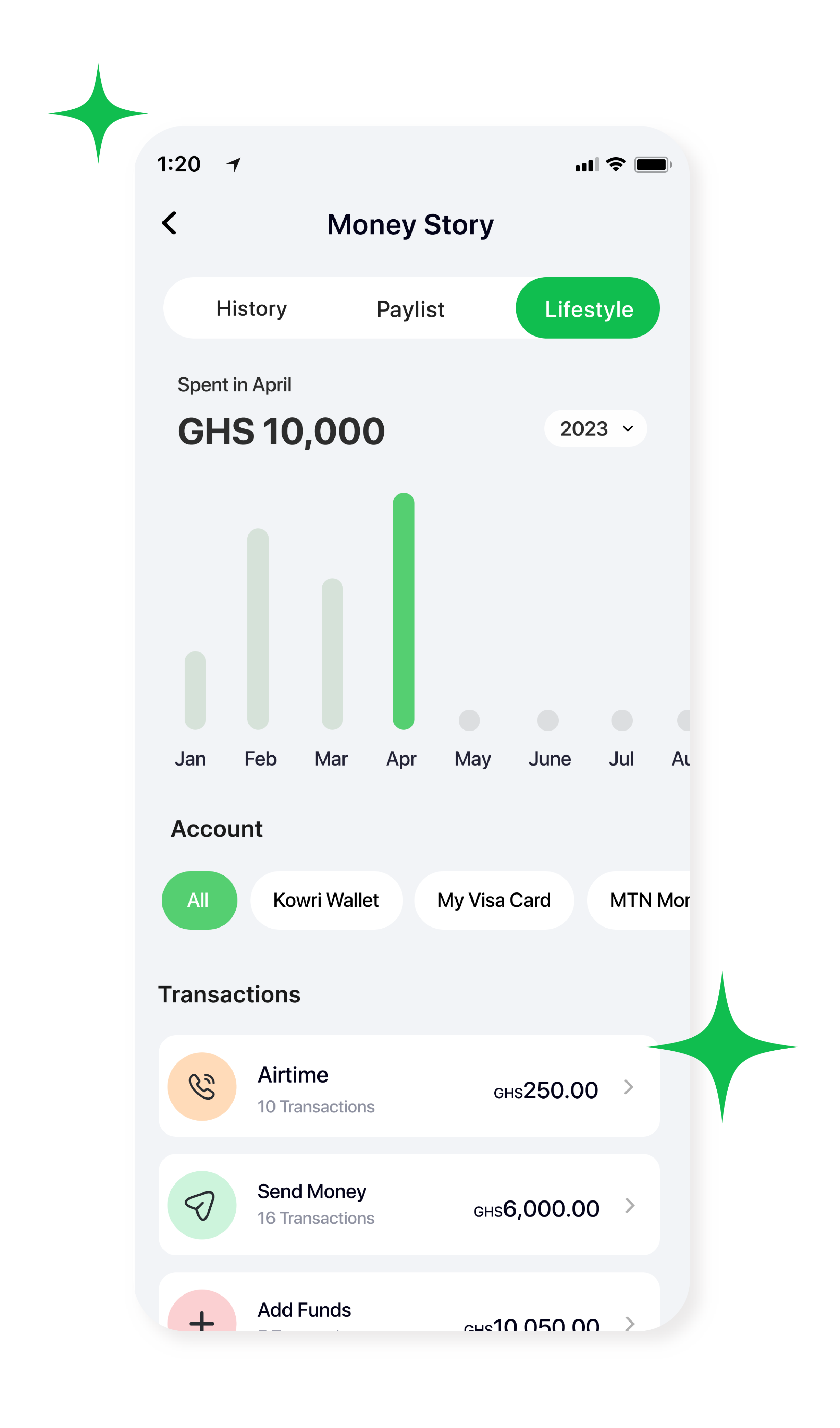

Manage. Know your limit!

Know how, where and what you spent at a glance. Kowri helps you keep account of every cedi.

Join the Kowri movement

Send, buy, pay and manage easily and securely in one app.

Experience Kowri. The way to pay

Get Kowri, the only Digital Financial App you will ever need.